The Credo

Company

Backstage at Johnson & Johnson

On May 20, about 100 stock analysts gathered in the ballroom of the Hyatt Regency Hotel in New Brunswick, New Jersey, to hear good news from top executives at Johnson & Johnson: The company had 10 new drugs in the pipeline that might achieve more than a billion dollars in annual sales.

For 129 years, New Brunswick has served as the headquarters of J&J, America’s seventh most valuable public company. With consumer products from Band-Aids to baby powder, Neutrogena to Rogaine, Listerine to Visine, Aveeno to Tylenol and Sudafed to Splenda, Johnson & Johnson is the biggest and, according to multiple surveys, most admired corporation in the world’s most prosperous industry—healthcare.

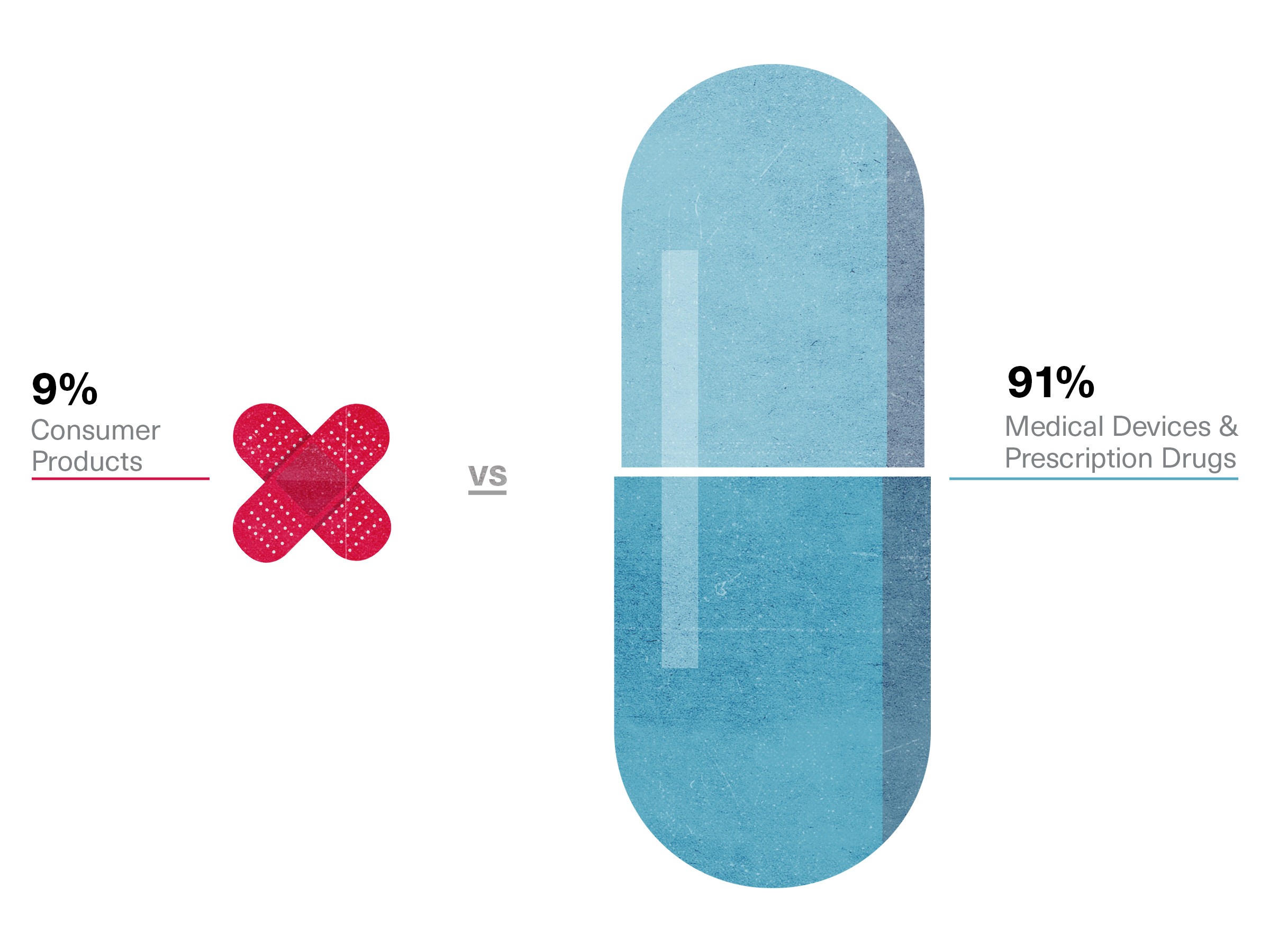

But the real money—about 80 percent of its revenue and 91 percent of its profit—comes not from those consumer favorites, but from Johnson & Johnson’s high-margin medical devices: artificial hips and knees, heart stents, surgical tools and monitoring devices; and from still higher-margin prescription drugs targeting Crohn’s disease (Remicade), cancer (Zytiga, Velcade), schizophrenia (Risperdal), diabetes (Invokana), psoriasis (Stelara), migraines (Topamax), heart disease (Xarelto) and attention deficit disorder (Concerta).

How J&J Makes Its Money

Ads for many of these products dominate our television screens and magazine pages. Each drug relies on its own elaborate marketing plan and carefully pitched promotional materials, used by hundreds of salespeople whose incomes turn on how much product they can push to the thousands of doctors who write prescriptions. All command increasing portions of our health insurance premiums and our own wallets, as well as our hopes and anxiety when we or our loved ones fall ill.

What follows is the backstage story of how an iconic company marketed a blockbuster drug that raised those hopes and fed on that anxiety. It is a story that in its depiction of strategies, tactics and mindset should make us wonder about the prescription drugs that are so much a part of our lives.

The show that Johnson & Johnson put on that morning for the analysts at the hotel, which the company owns, would produce positive headlines in the news that afternoon. But the upbeat talk in the lavishly appointed ballroom was a world apart from the drab setting where a Johnson & Johnson whistleblower says she sat in a sales meeting being drilled on promotional materials she was told should not be left behind for fear that federal regulators might see them.

In the ballroom, the Wall Street people watched J&J executives talk about the miracle drugs they were moving through clinical tests—not about how their colleagues might, as investigators later charged, massage data to conceal potentially damaging test results.

Whether it was the head of central nervous system research or the woman in charge of the drive to intercept diabetes before it strikes, everyone on the podium easily answered questions from the analysts on issues ranging from cell structures to potential market sizes to development timelines. They exuded passion and confidence—which was nothing like how Johnson & Johnson executives, however well-rehearsed by batteries of lawyers, would comport themselves under oath when asked to answer for how they marketed Risperdal, the company’s billion-dollar antipsychotic drug.

To sit in the back of the room watching the impeccably dressed, articulate men and women who are orchestrating Johnson & Johnson’s trailblazing cures for cancer, Alzheimer’s, diabetes, AIDS and mental illness, and to watch the Wall Street crowd digesting it and calculating the potential cash flows and returns on investment, was to watch the free market dream come true. The best and the brightest on that stage were doing well and doing good. Creating wealth by fighting pain, disease, death.

One could imagine Robert Wood Johnson, who founded the company with two of his brothers in New Brunswick in 1886 looking down proudly on the Hyatt ballroom—and in dismay at the grand jury hearings, depositions and trials that told the Risperdal story.

Putting Patients First

R.W. Johnson had worked at various jobs in and around America’s fledgling patent medicine industry before launching Johnson & Johnson as the world’s first supplier of surgical dressings and bandages. His enterprise was propelled by a single, big idea—that English scientist and surgeon Joseph Lister’s pioneering adaptation of Louis Pasteur’s work in microbiology could be turned into a worldwide market for antiseptic supplies that would ward off infections in wounds and surgery. With sales offices and factories spread across the globe and with annual revenues of $74.3 billion in 2014, his company had come a long way since creating a first aid kit for railroad workers in 1888 or the first prescription contraception product for women in 1931.

Even before Johnson & Johnson had grown little beyond a single factory with 14 workers in a small New Jersey town, its founder had donated supplies to soldiers in the Spanish-American War and to victims of a series of earthquakes and other natural disasters through the early 20th century. That public service ethic was memorialized in writing by Johnson’s son Robert Wood Johnson II, who built the company mightily over a 31-year reign that ended in 1963. The founder’s heir wrote what became the company’s ubiquitous, even cult-like, “Credo”—a 308-word statement that declares, up front, “We believe our first responsibility is to the doctors, nurses, and patients, to mothers and fathers, and all others who use our products and services.”

Employees and “the world community” come next. After them, the credo holds, the company’s “final responsibility” is to shareholders.

Patients first. Profits last.

The credo is mentioned seven times in the current chairman and chief executive’s latest annual letter to shareholders. As is tradition, it is reprinted in full at the beginning of the annual report. It is also carved in stone in the lobby of J&J headquarters and posted at all significant company events—including that morning’s stock analysts’ conference.

But the world in which Johnson & Johnson thrives today seems to have corroded the credo.

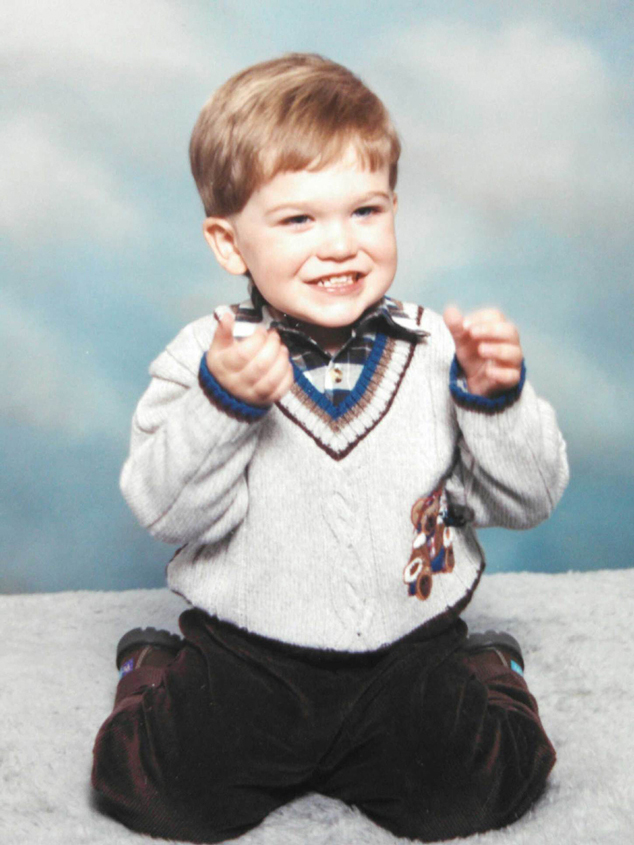

The Boy with 46DD Breasts

The morning of the conference, thousands of claims involving Risperdal were sitting on dockets across the country. Company lawyers had just filed motions appealing a $2.5 million verdict handed down by a jury in a Philadelphia courtroom 60 miles south of the Hyatt.

The jury found that Risperdal had deformed an Alabama boy after Johnson & Johnson had encouraged his doctor to prescribe it without warning of its risks. Austin Pledger, who suffers from severe autism and is now 21 years old, started growing breasts when he was 12 that eventually measured 46DD.

The Food and Drug Administration had prohibited Johnson & Johnson salespeople from trying to promote Risperdal to doctors to treat children because of its feared side effects, including hormonal disorders. The company was also not allowed to promote it to treat the elderly except for the most serious psychotic disorders; it was thought to cause strokes, diabetes and other ailments in that population. But by the time young Austin started growing breasts, Johnson & Johnson was reaping more than half of its Risperdal sales from prescriptions written for children to alleviate all kinds of behavior disorders, and for the elderly, who were given the drug for simple symptoms of dementia or restlessness.

Johnson & Johnson emails, sales training manuals and business plans produced as evidence in the case revealed that the company organized special sales units illegally targeting doctors who treated the elderly and children. State mental institutions treating children, whose drugs would be paid for by Medicaid, were targeted, too.

When it came time to explain their conduct at trials and to federal investigators, Johnson & Johnson executives and salespeople have unwaveringly, even indignantly, defended themselves. One salesman, who otherwise fit the salt-of-the-earth mold that R.W. Johnson had envisioned for his company’s employees, gave thousands of Risperdal samples in child-sized doses to Austin Pledger’s doctor in Birmingham, Alabama. Yet he insisted under oath in February he didn’t recall stepping around kiddie furniture and toys as he walked into an office with a sign that said “pediatric neurologist,” and that he had no way of knowing that the doctor wasn’t treating adults.

- Pledger v. JanssenFeb. 3, 2015 (p. 19-20, 51-52, 55-56)

- Pledger v. JanssenFeb. 4, 2015 (p. 31-32, 35-36, 38, 66-67)

More generally, Johnson & Johnson’s defense—as expressed to me over three hours of conversations with lead in-house litigator Joseph Braunreuther, who asked not to be quoted, as well as by others working for the company—is that the drug benefits many people, which is true, and that the law governing promotion to prohibited populations, called off-label sales, is vague, unworkable and punishes companies for providing information about the drug to doctors who treat patients who could be helped by it.

Johnson & Johnson declined to allow anyone to speak on the record about any of the Risperdal litigation or investigations, but as company Vice President for Media Relations Ernie Knewitz put it, "In our opinion, significant ambiguity exists about what is or is not permissible regarding the communication of truthful and non-misleading scientific information about FDA-approved pharmaceutical products. Like doctors, patients, and others in the industry, we share an interest in greater regulatory clarity on the rules for appropriate promotion and scientific exchange, and we are working through industry groups to bring clarity and consistency to the rules that apply to those communications.”

'The Cost of Doing Business'

Johnson & Johnson has already settled thousands of cases involving illicit promotion of Risperdal, including Department of Justice civil and criminal complaints, for a total fast approaching $3 billion.

But on the morning of the analysts’ meeting, the company was still manning the battle stations with squadrons of lawyers fighting off another 4,200 cases, apparently willing to risk a few more bad verdicts while hoping to weed out the weakest cases and wear the opposition down in order to save on final settlement costs of the strongest claims.

Yet all of that meant little to the stock analysts. “Oh, they’ve already reserved for that stuff,” one of them told me during a coffee break. He meant that in Johnson & Johnson’s financials, there had been money taken from earnings and put into a column vaguely called “accrued liabilities,” in order to account for the expected billions that might still have to be paid out in verdicts or settlements.

“It’s their cost of doing business,” the analyst added, perhaps unintentionally echoing the view of one senior J&J lawyer who told me that the cases against his company are the unavoidable price of dealing with a litigation system easily abused by those targeting big corporations.

“All the big pharmas” have lawsuits, the analyst concluded, sipping an espresso. “It’s just not a big deal.”

Indeed, with before-tax profits of $20.6 billion for 2014, putting aside $500 million or even $1 billion a year over 15 years to cover payouts for boys with 46DD breasts and other claims that might come along doesn’t put much of a dent in the company’s financials. As Johnson & Johnson declared in a filing with the Securities and Exchange Commission three weeks before the analysts’ conference, “In the Company’s opinion … the ultimate outcome of legal proceedings, net of liabilities accrued in the Company’s balance sheet, is not expected to have a material adverse effect on the Company’s financial position.”

Thus, as Johnson & Johnson’s press materials habitually point out, the company has recorded 51 years of increases in the dividends paid to shareholders.

“All the big pharmas have lawsuits,” the analyst concluded, sipping an espresso. “It’s just not a big deal.”

The Industry of Our Times

True, eight of the other nine largest pharmaceutical companies in the world have settled federal claims over the last decade related to allegations similar to what Johnson & Johnson was accused of in selling Risperdal, although their conduct was arguably less egregious. They, too, seem to have settled the charges without torpedoing their profit and loss accounts.

However, the fact that this illegal conduct is not a “big deal” on Wall Street and only the occasional subject of news coverage should make it a big deal to the rest of the world: The drug companies seem to be able to break the rules with relative impunity, or at least without suffering the kind of punishment that would actually hurt—their stock prices taking a hit or senior executives being held personally responsible.

Big Pharma is a big deal. The financial pages are filled almost daily with news of multi-billion dollar mergers and acquisitions among drug companies. Of the M&A deals announced so far this year in the United States, eight of the 30 largest involve drug-makers. Other headlines herald breakthroughs of the kind Johnson & Johnson executives were touting in the ballroom in New Brunswick. At the same time, healthcare policy wonks, government budgeters, insurers and patients are becoming increasingly panicked over who is going to pay for the miracle profits demanded by the manufacturers of these miracle products.

In terms of fortunes now being made and the industry’s impact on our economy, Big Pharma (or a little pharma that develops a miracle drug) is fast becoming today’s go-go industry. Profit margins often exceed those of industries, such as software, that we think of as modern gold mines. Only now the products have to do with life or death.

Amid the swirl of multi-billion dollar takeover deals generated by the prospects of a promising new drug, can we trust these companies? Can the data from the trials conducted to test their products that they submit to the Food and Drug Administration be trusted? Can we rely on corporations that are looking over their shoulders at Wall Street not to inflate revenue by selling a drug to people that the FDA has walled off as targets or for purposes that have not been sufficiently tested and for which the FDA has not granted approval?

Or are the lawsuits like those brought against Johnson & Johnson and other drug companies less about corporate wrongdoing and more about trial lawyers and whistleblowers (who get paid a portion of the winnings) looking for a payoff when drugs that comfort or even save the many result in side effects that afflict the few?

These questions are only going to loom larger as miracle drugs and miracle profits increasingly dominate the news, our budgets and our quest to live long, healthy lives. That is what makes the Johnson & Johnson Risperdal story important. It is why an examination of internal company and FDA documents produced in recent Risperdal suits and from Freedom of Information Act requests, supplemented by interviews with those involved in these events, is revealing.

The documents also demonstrate that as head of Risperdal sales and then head of the Johnson & Johnson subsidiary that marketed Risperdal, Alex Gorsky, the current Johnson & Johnson chairman and chief executive, had a sustained, hands-on role in what the company has since admitted in a plea bargain (that nonetheless named no individuals) was illegal activity. That raises significant questions about whether our legal system can, and will, ever hold the high-ranking people who run our largest corporations, rather than inert corporate entities, responsible for wrongdoing.

The Houdini act that enabled Gorsky, the then-Risperdal sales manager, not only to escape responsibility but also to be promoted to the top of his industry’s most admired company raises equally significant questions about the standards of conduct we can expect from those who run what is becoming the world’s most powerful industry, and about how much we can rely on the medicines they sell.

Through company spokespeople, Gorsky declined repeated requests to be interviewed about Risperdal, though he did testify in a deposition prior to the company's guilty plea, saying, “I don’t believe that we … marketed the product in an inappropriate manner.”

The DocuSerial

The Johnson & Johnson Risperdal story is a complex, roller coaster tale. The details count. They are important in understanding the people and impulses behind the drugs we take. To tell that story in a way that is digestible but complete, The Huffington Post Highline and I are trying something new: a DocuSerial. It’s a reconstruction of an old story-telling genre that allows us to deploy the modern tools of digital communication to engage readers in old-fashioned, long-form feature journalism.

Every day for the next 15 days, a new chapter of the Johnson & Johnson story will be posted here. Along with the text, we will post not only a rich array of photos and graphics, but also links to every document—court transcripts, internal emails, FDA staff memos—referred to in that day’s chapter. That way, you will be able to delve more deeply into the materials that are quoted. (You’ll also be able to make sure I held true to the context of the material I quote.)

Those chapters already posted in prior days will be stored on a readily accessible, expanding file, so that you can catch up on, or review, the unfolding narrative. At the end of the 15 days, the entire story, along with all illustrations, videos and documents—as well as the most important comments on or critiques of the DocuSerial—will be available in a complete package, which will then be updated as events and the ensuing discussion evolve.

A Plan Too Big for its Legal Market

Well before Risperdal was approved by the FDA and went on sale in February 1994, Johnson & Johnson had made the coming of the drug into something akin today to the launch of an Apple product.

The company needed a blockbuster that would replace and surpass its original antipsychotic drug, Haldol, which had gone on sale in the late 1960s.

Haldol had been invented in the laboratories of Paul Janssen, a legendary Belgium chemist whose father had founded a small pharmaceutical research lab in the 1930s. R.W. Johnson II had purchased the company in 1961 in what became a critical pivot by Johnson & Johnson away from medical supplies and toward the blossoming, high-margin prescription drug business.

Haldol and competitors, such as Thorazine, were considered “first-generation” antipsychotics—drugs that could treat symptoms associated with mental disorders such as bipolar disorder (manic depression, usually causing severe mood swings) and schizophrenia (typically defined as a severe brain disorder causing people to interpret reality abnormally, as with hallucinations).

In order to hit J&J's projections, Risperdal would have to be used by tens of millions—not simply a portion of the one percent of Americans having the most severe psychotic disorders.

But Haldol had come “off-patent” in 1986. That meant that the years during which the product was protected from being copied were over. Inexpensive generic versions of Haldol had decimated the brand name’s revenues by 1992.

The business plan the Janssen executives had drafted projected an average of more than $1 billion in U.S. sales of Risperdal every year through the turn of the century. (U.S. sales were about two-thirds of worldwide sales for these kinds of prescription drugs.) That meant that Risperdal would have to be used by tens of millions—not simply a portion of the one percent of Americans having the most severe psychotic disorders.

Right from the beginning, the FDA took a different view. In a memo to his colleagues a week before the final approval, the agency doctor in charge of the Risperdal application reported that he and Janssen scientists and executives had reached an “impasse” over the label that the FDA would allow.

A prescription drug’s label is a dense, multi-page document given to doctors so that they know what a drug is supposed to be used for, what side effects to look out for and what the appropriate doses are. It is based on a series of tests conducted by the drug’s manufacturer, or “sponsor”—first on animals, then usually on humans over three increasingly stringent phases. All the steps along the way, which can take three to 10 years, are done in close consultation with the FDA, which reviews the testing data that the sponsor submits.

Janssen wanted the label for Risperdal to include “side by side” statistical comparisons with the wildly popular Haldol. This was unacceptable, the FDA doctor wrote, because it “invites a comparison that leads to the conclusion that Risperdal has been shown to be superior to [Haldol] when, in fact, it has not.”

In other words, Janssen wanted its new drug to seem like a step up from its now-generic, inexpensive product. But the clinical data didn’t prove that.

There was another issue lurking in Janssen’s push to have Risperdal compared to Haldol. By then Haldol and its generic knock-offs were being widely used to address a broad range of behavior disorders, including dementia in seniors and attention deficit disorders in children—not just severe “psychotic disorders,” such as hallucinations or delusions. Risperdal could never replace Haldol as Johnson & Johnson’s latest bestseller if it was sold as only appropriate for psychotic disorders.

An ambitious plan drafted by Janssen in anticipation of the drug’s 1994 rollout put the problem bluntly: “The anticipated growth of the antipsychotic market does not create enough room for the Risperdal sales forecast.”

But the FDA held firm. Its approved label limited Risperdal to the “management of manifestations of psychotic disorders” in adults—severe illnesses causing hallucinations or delusions.

Worse, drawing on the data Janssen had submitted, the FDA specified that the “antipsychotic efficacy of Risperdal was established in short term (6 to 8 weeks) controlled trials of schizophrenic patients.” Schizophrenics were only about a third of the psychotic disorders market, which was itself a small subset of the target population Janssen had in mind.

“It would be misleading to suggest that the safety and efficacy of Risperdal has been established in the elderly,” the regulators wrote.

Compounding the problem for J&J’s business strategists, the FDA’s December 29, 1993, letter officially approving the sale of Risperdal warned that the agency would “consider any advertisement or promotional labeling for Risperdal false, misleading or lacking fair balance” if it stated or implied that “Risperdal is superior to haloperidol [Haldol].”

The letter was signed by Dr. Robert Temple, a highly regarded specialist in clinical trials who had joined the FDA in 1972.

“Our role is not to decide that one drug is more effective than another drug, or to say that they’re equally effective, even if one is much more expensive,” Temple, now the FDA’s Deputy Center Director for Clinical Science, told me. “If the data that the sponsor submits demonstrates that the drug is effective and the potential benefits of its intended use outweigh the risks, we approve it. But,” he added, “it has never been clear to me that Risperdal was more effective than Haldol, and we never allowed them to claim that.”

No Old Folks,

No Kids

Later in 1994, when Janssen submitted for FDA approval some promotional materials meant for doctors who treat the elderly, it got back another letter bomb. This one struck at the heart of what the company’s strategic planners envisioned as a key market. “It would be misleading to suggest that the safety and efficacy of Risperdal has been established in the elderly,” the regulators wrote.

The following year, Janssen submitted a new proposal to the FDA to conduct studies among geriatrics that would justify expanding the label to meet those market aspirations. Again, the FDA refused to go along.

“You appear to be exploring Risperdal’s potential value for a much broader and more diffuse clinical target, namely ‘behavioral disturbances in demented patients,’” Dr. Paul Leber of the FDA wrote. That label, he continued, “would also encompass a range of other clinical findings, e.g., anxiety, depression, agitation, aggressiveness, verbal outbursts, wandering, etc. that would not necessarily be considered psychotic manifestations.”

Seeming to anticipate the mental institutions and nursing homes that were a big part of the market targeted in Johnson & Johnson’s business plan, Leber added, “Some [of these symptoms] … might even be construed by some as appropriate responses to the deplorable conditions under which some demented patients are housed, thus raising an ethical question regarding the use of antipsychotic medications for inappropriate behavioral control.”

Leber and the FDA appeared to have Johnson & Johnson boxed in.

A year later, in August 1996, Janssen submitted another proposal to the FDA. This time, it involved expanding the label to include children. Again, the agency rebuffed the company, declaring, “Your supplement [to the approved label] proposes the expansion of Risperdal use into pediatric patients, however, you never state for what child or adolescent disorders Risperdal would be intended. Indeed, you acknowledge that you have not provided substantial evidence from adequate and well-controlled trials to support any pediatric indications, nor developed a rationale to extend the results of studies conducted in adults to children.”

“Your rationale for proposing this supplement,” the agency concluded, “appears to be simply that, since Risperdal is being used in pediatric patients, this use should be acknowledged in some way in labeling.”

That last sentence hinted at efforts Janssen had already quietly made to expand the sale of Risperdal beyond the limits of the label. By 1997, overall Risperdal sales in the U.S. had reached $589 million. That was a huge jump from launch-year revenue of $172 million in 1994, and it meant that the drug was somehow being prescribed for patients outside the narrow boundaries of the label.

How?